(Pic: Bushfire ravaged Tree ferns a riot of green above Batemans Bay on the Kings Highway.)

If the last month didn’t convince you I don’t know what will.

Despite all the challenges… here is my opinion. You live in one of the best places on earth, some call it the lucky country. I prefer to call it providence.

In some of the most difficult circumstances imaginable, our nation has just managed an infection rate to a very “flat” curve indeed.

Our death rate has thankfully stalled.

Many (and increasing numbers) of us are now back working again.

For those that weren’t / aren’t… my thoughts are with you.

It’s not normal, but it isn’t armageddon either.

We have seen the release and implementation of one of the more generous economic programs anywhere (granted, it’s not perfect and some people are falling through the cracks) so the majority (sadly not all) of employees and business have some support.

Whilst I have no desire to start a political debate, I really am impressed how our leadership managed it all. I would not have wanted their job for quids.

I hope you are personally safe and well. I hope during the last few months of lockdowns you experienced more gains, more rest, more quiet relaxation. My hope is that these outweigh the stress, fear and anxiety we all had to manage.

For some, things are far from over. For others not much changed.

Regardless we have just come through an amazing moment in history together and I remain thankful for the many blessings we have in this corner of the globe.

How have real estate markets been fairing?

Well I have been amazed at the resilience of our property markets.

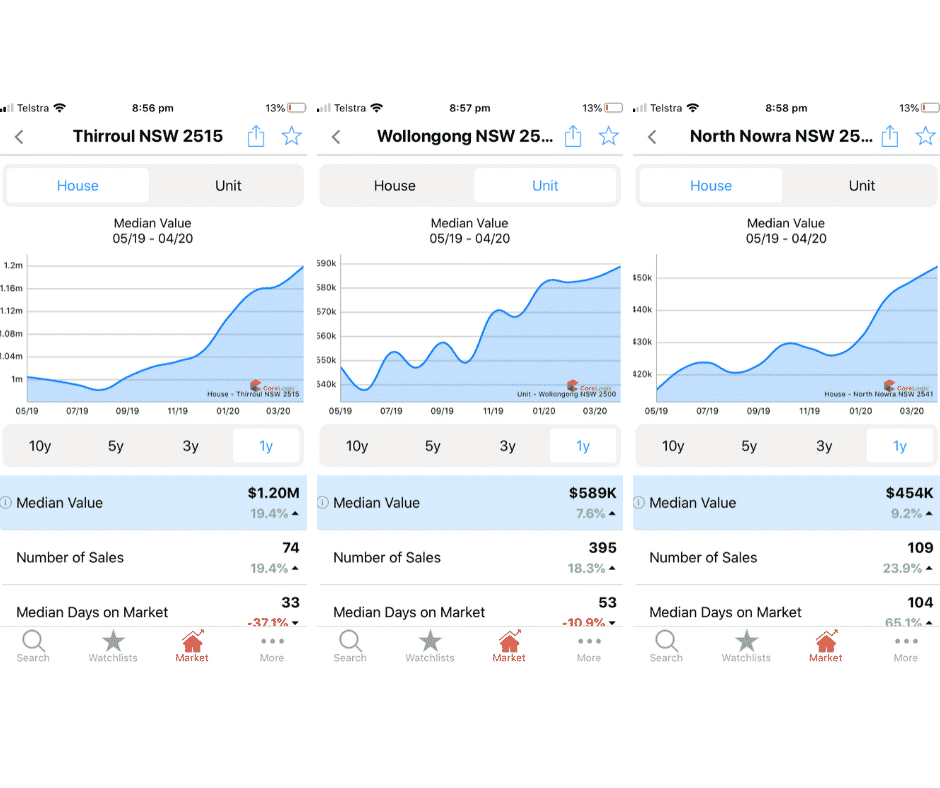

Prices have held up remarkably well. Below are some of the suburbs where I have helped clients make recent 2020 purchases and as you can see there has been hardly a backward step in these markets to date. Houses and units selected based on what we purchased. (shamefully low charge on my iphone btw – admittedly it was late in the day)

Not all markets are equal of course. But we don’t buy “all markets” in real estate. Now more than ever you must know your local patch, get granular.

I am not saying falls are impossible. If unemployment went as viral as Covid it would have to impact house prices eventually. Time will tell on that front.

However, what we have seen so far is that quality areas are still attracting quality buyers.

Our banking system has not collapsed.

Many people still do have jobs.

Many people can still get finance.

Many first home buyers and relocat-ers are taking the opportunity to grab a property with less competition from investors.

Lenders are still lending. My most recent client were granted formal approval in a record (for me) timeframe of 2.5 hours from the valuation (normal it is 2-3 days and sometimes weeks). This was not to a multimillionaire – it was to a young working couple.

When attending beach home inspections for clients I have seen a fresh pulse of boomers keen to leave the city and the moment travel bans were lifted we started seeing them at open homes en masse.

I chatted to a few last week. The vibe seems to be “Carpe Diem”…Seize the day! “Stop delaying that sea change move any more… do it now or never. The city is full of germs anyway”.

So for some, the dream isn’t just alive, it is being fast-tracked.

What about the predicted widespread market falls? I just haven’t seen it in the data yet.

For more historical look at property markets vs pandemics, I will let the others do the hard work.

… the summary in this article is that during the Spanish Flue rents did fall but recovered quickly.

…and from here we see that during the same time prices didn’t fall

… and from much smarter analysts than me some predictions:

… and this article from API Mag as well as this report from John Lindeman more bullish than bearish as well.

Now I know there are a range of possibilities, and that I am biased. I am a buyers agent, not a fortune teller.

All I can say is that yet again I am reminded why I decided real estate was a great kind of asset at the age of 19 (22 years ago!)

Nothing I have read in the doomsday forecasts (they are out there on the front page of the papers and I won’t bother to link them) has convinced me. The data hasn’t proved them right.

I wonder if it is because Australians simply don’t firesafe or foreclose on houses unless they really have to. Not unless we see huge (scary huge) unemployment. Which is possible, of course, but at this stage I would say I remain an optimist.

There are very different narratives out there.

The media said my kids would not be back at school for the entire year. They went back last week.

The media said many more would die. They haven’t. At least not here in Australia. Our hearts are with those nations not faring as well.

We were told we would be locked in our houses for months with no end in sight.

As bad as it has been (and of course it is bad) on a societal level we have fared very well thus far. So have our property markets in many local areas.

Ultimately I believe it will keep coming back to the fundamentals, supply, demand, human behaviour.

This article last week in the Australian provided a more optimistic alternative.

The truth is neither me nor any other commentator really knows the future. Whether investing or considering a move for yourself. Be careful, double check your employment, your finance and your cash reserves.

But what I have seen in recent months is that if it makes sense to sell or buy a home, people are still going about those things in very ordinary ways. Prices and terms haven’t changed much. Stock remains low and demand high which makes it more important than ever to secure your properties pre or off market if you can. (our last 2 client deals were both off market)

Zooming out, take care of your mental health. Gratitude is a good start. I’m sure like me you have lots to be thankful for in recent times. It never gets old reminding ourselves of those things.

And if a global pandemic has prompted even a few of us to follow our hearts and stop delaying our dreams – isn’t that a good thing?

Hi

Will the price of the property go down or rising up

I am a first home buyer and I want to buy a house but I don’t what will happen

Is it the right time to buy a property?

Can you give me some advice please

Thanks

Hi Zara, as I said I really don’t want to try and crystal ball what will happen next. There are some crazy things happening all over the planet right now. Employment is a big risk locally. But low-interest rates, easing travel/work restrictions and more economic stimulus provide upward pressure at the same time. I have some goal setting materials if you want a framework to think through your own situation to make good long term decisions – just reach out by email if you would like them.

Fantastic article Matt, love it 🙂

Hi Matt,

Thanks, great to hear some positive news for a change!

I’m getting some financial advice about possibly selling a house in Mangerton/Wollongong.

Could I ask how things are looking for growth in house values in that suburb? The house is around the $1-1.1mil mark.

Hope you’re all well.

Jo! It is great to hear from you again. Mangerton is a lovely suburb and demand has been quite strong. For the current graph from RP Data I will have to msg you as I am not quite technical enough to attach it to the comments here. Give me a ring sometime and we can chat about anything personal.

Thanks for the comments Matt – very valuable

Good commentary and summary Matt.